Aug-2024

Point-source carbon capture for industry decarbonisation

Compact, modular units bring carbon capture within the reach of more companies and hard-to-abate industries with their seamless integration.

Prateek Bumb

Carbon Clean

Viewed : 4001

Article Summary

Point-source carbon capture is the most efficient and cost-effective technology to decarbonise hard-to-abate sectors, which account for around 30% of global CO₂ emissions. The technology is available, but current adoption levels are not on track to meet global net zero targets. This article discusses the current rapid growth of carbon capture and storage (CCS) globally, along with the challenges and opportunities across markets, and how modular carbon capture technology will help deliver the transition of industry to reach net zero.

Introduction

To keep global warming to no more than 1.5˚C, as called for in the Paris Agreement, emissions need to be reduced by 45% by 2030 and reach net zero by 2050 (UN, 2024). However, the UN recognises that we are not on track and that there is a rapidly narrowing window to achieve this. We need to raise global ambition while recognising this is a serious challenge that requires a multifaceted approach because there is no silver bullet to decreasing emissions across all industries.

This urgency is particularly relevant and important in heavy industry. Sectors like cement, oil and gas, shipping, steel, and industrial power are crucial for society, growth, and the global economy. However, these industries, which together account for 30% of global emissions, face some of the biggest hurdles to decarbonising their output. With their significant operational footprint, high energy intensity, and technical processes, the challenge at hand is no easy feat. The ongoing costs companies in these sectors must grapple with means the pathway to decarbonisation offered by some solutions is too expensive and, therefore, not viable to adopt.

Within this context, demand is rapidly increasing across global economies for products compatible with, or contributing to, net zero targets, such as green steel. The enablers of these types of products? Today, they include green hydrogen, electrification and biomass, and carbon capture, utilisation and storage (CCUS),

Offered as a key decarbonisation solution for heavy industry, CCUS is now available to the market and is increasingly recognised as one of the only commercially viable options for managing emissions. The difficulty is that adoption levels are currently not on track, with the International Energy Agency (IEA) and others calculating that global CCUS deployment must be 100-120x greater to reach current net zero targets.

A rapidly growing market

This surge in awareness and urgency has helped propel the CCUS sector into a phase of growth. Data published by McKinsey expects average annual investments in CCUS to reach up to $175 billion by around 2035 and could surpass today’s gas investments by as early as 2026 (McKinsey & Co, 2022). This shift in expectations is already being reflected in the capital the industry has been able to attract, with investment having almost doubled from $6.4 billion in 2022 to a record high of $11.1 billion in 2023.

Carbon Clean, which is focused on decarbonising hard-to-abate industries through carbon capture, serves as a prime example of investor appetite, having raised $150 million in its Series C round two years ago with support from industry-leading companies such as Chevron, Cemex, and Marubeni. It was the largest ever funding round for a point-source carbon capture company.

We can see this momentum being translated in CCUS projects deployed worldwide. Last year saw an exponential growth of global policies, projects, and collaborative activities focused on CCS, with the project pipeline reaching unprecedented capacity. The Global Status Report from the Global CCS Institute (GCCSI) highlights a 48% increase in capture capacity over the past 12 months (GCCSI, 2024). The CO2 capture capacity of all CCS facilities under development has grown to 361 Mtpa (from 244 Mtpa in 2022). There were 26 new facilities starting operations and in construction in 2023, part of the 392 projects in the global CCS pipeline. The total breakdown is: 41 facilities in operation, 26 in construction, 121 in advanced development, and 204 in early development.

Meanwhile, announced capture and storage capacity have increased by 35% and 70%, respectively, since 2023. This trend is expected to continue as governments around the world continue doubling down on their climate ambitions, with CCUS presenting the most advanced solution for industry to address both current and legacy emissions from existing facilities.

Large, costly, and complex CCUS projects will only chip away at global emissions. Deploying modular, standardised carbon capture solutions across many industrial sites will deliver more for climate mitigation and local economies. Providing support for dispersed sites and mini clusters will help local communities benefit swiftly from this new era of carbon capture. The CCUS supply chain offers significant opportunities to create well-paid, skilled jobs and economic growth, with first movers likely to reap the highest rewards.

Modular carbon capture solutions

Carbon capture technology has been around for decades, but only recently has serious progress and growth been made. Historically, the barriers of space, cost, and convenience meant that proof-of-concept designs never properly made it to commercial deployment, but recent innovations have changed the game.

Today, leading technologies are proven, affordable, and scalable. This is crucial because even major industrial companies lack the funding, space, or time to implement bulky CCUS solutions across their operations.

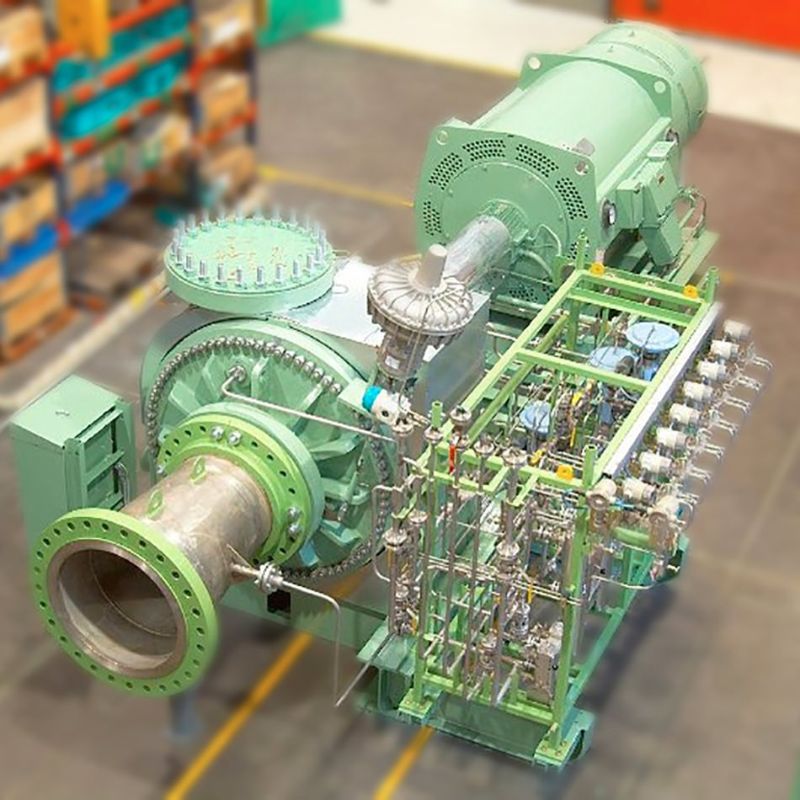

The solutions making a difference today are modular, often prefabricated, and point-source, meaning they can be installed to capture the industrial flue gases directly from the source. Modular CCUS represents the next frontier for the industry by significantly decreasing the size of the technology, standardising the model, and making it significantly easier for industrial players to install in their facilities.

Not only does this mean that companies can install the technology with minimal disruption to their operations, but they can also increase scale as budget and decarbonisation targets allow, thereby decreasing the upfront risk of investment and increasing deployment.

Add your rating:

Current Rating: 5